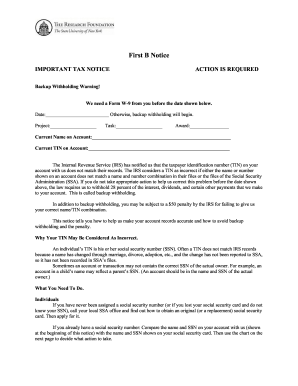

What are B notices from the IRS?

B Notices are sent to IRS Form 1099 filers who've submitted a name and taxpayer identification number (TIN) combination that doesn't match the IRS database. Filers have a 15-day window to take action on the notices, and send updated TIN solicitations.

How do I remit withholding tax?

The person making the payment deducts tax prior to paying the amount due. The tax withheld/deducted is then remitted to the KRA. The payer is required to generate a withholding tax certificate on iTax which is automatically sent to the payee once the payer remits the withholding tax to KRA.

How do you submit backup withholding?

Employers that withhold taxes from certain payments must file a Form 945. For example, you'd have to file Form 945 if the IRS required you to make backup withholdings on an independent contractor's pay.

What happens with backup withholding?

What is backup withholding? There are situations when the payer is required to withhold at the current rate of 24 percent. This 24 percent tax is taken from any future payments to ensure the IRS receives the tax due on this income.

What accounts are subject to backup withholding?

Payments subject to backup withholding Attorney's fees (Form 1099-NEC) and gross proceeds such as settlements paid to an attorney (Form 1099-MISC) Interest payments (Form 1099-INT) Dividends (Form 1099-DIV) Payment Card and Third Party Network Transactions (Form 1099-K)

Who qualifies for exemption from withholding?

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

How do I know if Im backup withholding?

Am I subject to federal backup withholding? You received specific notification from the IRS stating that you are subject to backup withholding. You fail to furnish your taxpayer identification number on Form W9. You provide the wrong taxpayer identification number.

Under which circumstance would a payer not be subject to backup withholding?

Upon opening a new investment account or making an investment at a bank for the first time, it's important that you provide them with your name and TIN or SSN. As long as you provide an accurate W-9 to the institution you're investing through, you don't have to worry about backup withholding tax.

The TIN Notice is sent by the IRS when the taxpayer identification number (TIN) is not correct. The 2nd TIN Notice is the second notice sent by the IRS in three calendar years. When the 2nd TIN Notice checkbox is selected, the IRS will stop sending you TIN notices on the current account.

How do I know if I'm exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

How do I know if I have backup withholding?

Most people are not subject to federal backup withholding. The IRS notifies taxpayers if they are subject to backup withholding. Any of the following reasons may cause your account to be subject to backup withholding: You received specific notification from the IRS stating that you are subject to backup withholding.

Why is my bank asking about backup withholding?

This is known as Backup Withholding (BWH) and may be required: Under the BWH-B program because you failed to provide a correct taxpayer identification number (TIN) to the payer for reporting on the required information return.

How does the IRS notify you of backup withholding?

The IRS notifies the payer to start withholding on interest or dividends because you have underreported interest or dividends on your income tax return. The IRS will do this only after it has mailed you four notices over at least a 120-day period.

How do I submit a backup withholding to the IRS?

If you withhold or are required to withhold federal income tax (including backup withholding) from nonpayroll payments, you must file Form 945. See Purpose of Form 945, earlier. You don't have to file Form 945 for those years in which you don't have a nonpayroll tax liability.

What is a notice CP2100A?

CP2100 and CP2100A notices are sent twice a year; an initial mailing in September and October and a second mailing in April of the following year. The notices inform payers that the information return is missing a Taxpayer Identification Number (TIN), has an incorrect name or a combination of both.

How do you know if you're exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

What is a CP2100 b notice?

Payer information The IRS will issue a CP2100 or CP2100A Notice if the payee's TIN is missing or obviously incorrect (not 9 digits or contains something other than a number) or their name and TIN on the information return filed does not match the IRS's records.